Lifecycle Stage: One part of CRM Segmentation

The Importance of CRM Segmentation

CRM segmentation allows businesses to tailor their marketing efforts to specific groups of customers, enabling them to deliver relevant and personalized experiences. By categorizing customers based on their needs, preferences, and behaviours, businesses can create targeted marketing campaigns, improve customer satisfaction, and increase overall sales.Understanding Lifecycle Stage:

Lifecycle stage segmentation categorizes customers based on where they are in the buyer's journey. It typically includes stages such as leads, prospects, customers, and advocates. This segmentation allows businesses to understand the different needs and expectations of customers at each stage and deliver appropriate messaging and offers. I typically work with this breakdown:

- Lead

- Marketing Qualified Lead (MQL)

- Sales Accepted Lead (SAL)

- Sales Qualified Lead (SQL)

- Opportunity

- Customer

- Partner

- Other (These can be people who are evangelists or potential partners that aren't a good fit. You want to include them but they don't have an immediate value for your funnel)

However, it is essential to remember that lifecycle stage segmentation alone is not sufficient for a comprehensive CRM strategy. While it provides a valuable starting point, businesses need to consider other factors to create a more accurate and effective segmentation model.

Lifecycle stage VS lead score?

A good lead score can be an important mechanism to resurface leads either to your Sales team or for your Marketing team to target with more specific campaigns. I've written about how to use lead score before, let's take a closer look at which data points can be part of your lead score.

Datapoints other than lifecycle stage to consider when segmenting your database:

- Demographics: Demographic information such as age, gender, location, and income can provide valuable insights into customer behaviour and preferences. By considering these factors alongside the lifecycle stage, businesses can further refine their segmentation strategy. For most B2B businesses these data points are hard to come by but you can work with your team to define your buyer persona's and build content and conversion opportunities based on these validated assumptions.

- Psychographics: Understanding customers' attitudes, values, and interests can help businesses create more personalized and targeted marketing campaigns. Psychographic segmentation can be achieved through surveys, social media listening, and analyzing customer interactions. In practice, this comes into play when a business has a well-functioning commercial setup and is looking to really engage with its audience on a closer level. When I worked as a CSM/ Partner Manager at HubSpot we used to host 'film nights', every rep brought a customer call recording to the meeting. We listened to it together (and believe me, this was rough!) and gave each other feedback. Obviously, it taught us something about how we communicated with our customers but it also let us focus on what the customer experienced, what they valued and how we impacted their business. Some of the lessons learned from these sessions are now, a decade down the road, still valuable to me.

- Behaviour: Analyzing customer behaviour, such as purchase history, browsing patterns, and engagement with marketing materials, allows businesses to identify patterns and tailor their messaging accordingly. This behavioural segmentation goes beyond lifecycle stage and provides a deeper understanding of individual customers. You can start as simple as identifying the assets your audience engages with before they become a MQL.

- Customer Lifetime Value (CLV): CLV measures the total value a customer brings to a business over their entire relationship. By segmenting customers based on their CLV, businesses can prioritize their efforts on high-value customers and create strategies to maximize their retention and loyalty. This data point can eventually enrich the tiering of your Ideal Customer Profile'

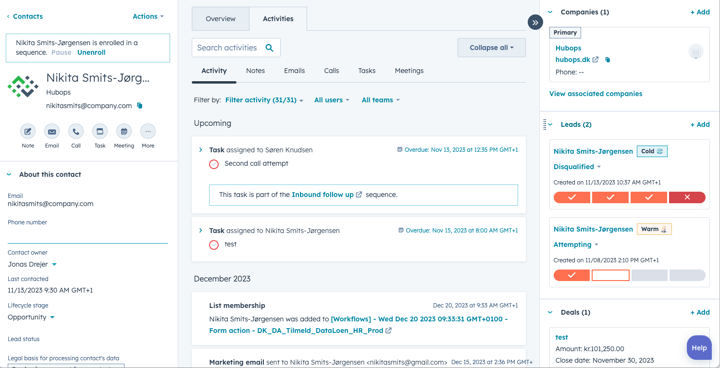

Segment within into your lifecycle stages

Lifecycle stages should be the minimal data point you collect. They show us where a prospect or customer is in their overall journey with your business. Just tracking the lifecycle stage leaves you with plenty of blind spots.

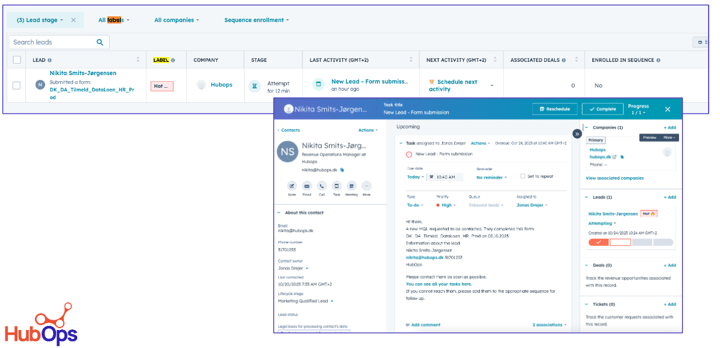

Context for your MQL's

An MQL might need a bit more context, was this a handraiser who requested a demo or wanted to know more about pricing? Or was this a scored lead resurfaced to your team? An MQL who completed a demo request is looking for an answer as soon as possible and from the right rep in your team. Perhaps someone owns the account and has relevant knowledge due to unrelated outbound work. How you hand over this MQL and the context you provide to your SDR team matters greatly. They should be enabled to pick up the phone and call your lead as soon as possible without having to ask this person basic questions that can be answered using data in your CRM.

A scored MQL however, might benefit from a softer approach, the fastest way to burn your hard-earned marketing leads is to aggressively cold call them without context. A well-thought-through sequence, reaching out to the prospect where they prefer to communicate in a helpful and consultative way is likely to add to your reputation as an expert in your industry and is more likely to show for itself in a higher conversion rate. Repeatedly sending direct messages on LinkedIn without context is a rather fast route to spam reports for your reps.

Why context on your MQLs matters

Hand raisers tend to have a different conversion rate to both meetings booked (Sales Accepted Lead) and revenue attributed (Opportunity or Customer). This has long term implications for your pipeline as you'll likely need to generate plenty more scored MQLs than hand raiser MQLs to get to the same revenue amount.

This is a nice example from Liam Moroney from Storybook Marketing:

In both scenarios, the total number of MQLs remained steady at 100. However, there was a significant 40% decrease in the number of handraisers.

This decrease in handraisers directly impacted the conversion rate, resulting in fewer meetings booked that couldn't be compensated for by an increase in scored MQLs. To put it into perspective, to make up for the drop in demo requests, you would need to quadruple the number of MQLs.

Aggregate numbers often conceal underlying issues within a program, making it crucial to identify these conversion trends early on. This allows you to not only track their progress throughout the funnel but also observe how your campaigns contribute to these two segments.

Identifying the trend of these types of conversions early on allows you to track how they trend over time allowing you to not only keep track of how they convert down the funnel but also see how your campaigns feed into these two segments.

Identifying the trend of these types of conversions early on allows you to track how they trend over time allowing you to not only keep track of how they convert down the funnel but also see how your campaigns feed into these two segments.

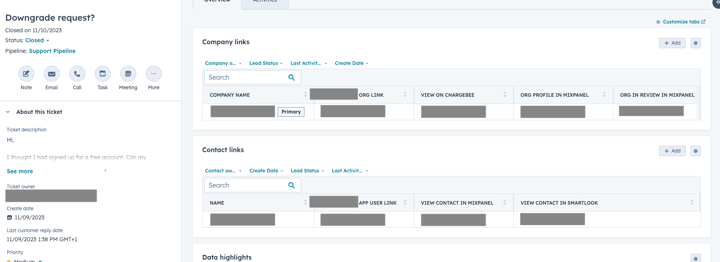

Lead Status and Lifecycle stage

Now, I'm aware that usually when I start talking about how to manage lifecycle stage, Ideal Customer Profile or ICP, Buyer Persona and Lead status together, people see me like this:

This is usually also where I start talking about the importance of mapping your process in a lead flow map to make sure everyone understands how all these data points work together.

This is usually also where I start talking about the importance of mapping your process in a lead flow map to make sure everyone understands how all these data points work together.

These are the default lead statuses I work with:

- Empty if we’ve never actively worked the lead or if they’ve never raised their hand for example through a demo request or price request

- New, either the company indicated them as a lead to be worked or the lead raised their hand through a form request

- In progress, a sales rep sets the lead to SAL (They might not have reached out to them yet but they are in their name and they might be researching them)

- Connected, lead is enrolled into a sequence in HS - Might be email, linkedin or phone.

- Qualified: Deal created

- Not ready: Good fit, no current opportunity but the company wants to sell to them in the future

- Unqualified: Human confirmed this is a bad fit company

- Marketing unqualified: Based on marketing data (automated) it looks like they’re not a fit, wrong industry or too small

Simply but, the Lead Status looks at engagement your team has had with the prospect or customer. So if they're an MQL and the lead status is set to 'new' this lead needs a phone call as soon as possible because they asked for something. If they're an SAL with the lead status 'connecting' it means that based on the reps' research this is a good fit lead for the business but they haven't had a chance to speak with the prospect yet. If the SAL is Unqualified but never had the lead status 'connected' we want to look at why and how they were unqualified.

Which takes me to the next data point:

Unqualified and not ready reasons

One of the worst things I can find in a CRM used by a commercial team who has a few years worth of data is an open text field for Unqualified reason. Sure, it's not the end of the world and if you have a dedicated team you might have a long list of reasons you can export into an excel sheet and group into categories but there is no need for this if you setup your unqualified reasons right from the start.

More than any of the other data points, unqualified and not ready reasons are very specific to your business and your industry. Some of the basic reasons I use are these:

Unqualified reasons

- Wrong industry

- Too small

- No decision maker (Contact)

- Fake lead

- Incorrect data

- Partner

- Competitor

- Other (comment required)

Not ready reasons

- No time

- No budget

- Unreachable

- Other (comment required)

I would always make the field for 'other' required in the CRM and I regularly check in on this field to see if the reasons should be updated.

The unqualified reasons can tell you a lot about the referring source or campaign, Meta advertising campaigns might be cheaper compared to LinkedIn campaigns but give you private email addresses and might mean a much higher rate of 'unreachable' MQLs.

Finally: Deal or pipeline stages

For obvious reasons, this data point is available for most businesses with a longer sales process.

Numerous factors can fuel the necessity for more intricate data. It could be the result of private equity investment and a board that insists on detailed reporting, or perhaps the company is exploring the feasibility of a new product or service, leading to an immediate need for more granular insights into current operations.

Firstly, you want your deal stages to reflect the hurdles your team needs to get through with their prospects. What are the crucial points a deal get stuck? Or what kind of information or commitment signals an increase in likelihood to close?

Secondly, you'll want to record your closed lost or closed won reasons like you've done with your not ready and unqualified reasons.

Why did your business win this deal? Was it price (and you're consistently lower priced than your closest competition? That opens up a whole new can of worms) or was it a feature that deserves more development?

Why did your business loose the deal? Was it perceived trouble for onboarding and activation or are you losing to competitors? Was it a lack of education for a particular buying role?

These data points can provide valuable feedback for Marketing, Business Development, Account Management and Product teams.

Maximizing CRM Segmentation

To harness the full potential of CRM segmentation, businesses should consider a holistic approach that combines lifecycle stage with other segmentation factors. By integrating demographic, psychographic, behavioural, and CLV data, tracking how your reps engage with leads and keeping track of unqualified and not ready reasons, businesses can create more accurate and targeted segments that drive better results. This means optimised marketing spend and more targeted campaigns. This means more detailed performance metrics for your SDRs or business development team

Largely this work is a 'set it and forget it' job. The framework and the automation behind it will continue to do it's job. However, you want to make sure to dive into the specifics regularly to see how the data trends and adjust your stages or reasons from time to time.

How about you? Have you optimised your CRM segmentation and do you structure your prospect and customer data in a way that is useful to your team? Feel free to book a free meeting to discuss what the next steps could be for your business. I'd love to hear how much of this setup you leverage today and what is working for you.